Key Takeaways:

It’s back to school season, which means families are in the throes of completing forms, meeting teachers, new clubs and sports teams, and tackling the never-ending school supply list. With the age of my kids, I expect this school year will mean a lot of time focused on handwriting, reading, and basic math problems. God bless our teachers!

One subject that is likely not being taught to our children is financial literacy. Only 1 in 6 students will be required to take a personal finance course before earning a high school diploma, according to nonprofit Next Gen Personal Finance.

While my 7-year-old’s piggy bank is already heavier than mine ever was, in no time they will be applying for a summer job and, what’s scarier, living on their own where we’re not around to monitor, teach and guide.

Therefore, it’s never too early to start teaching lessons about money. Does your child understand the difference and relationship between cash and a debit or credit card? Or why we don’t buy something even if we have the money? Financial tradeoffs, interest rates and the importance of saving and having an emergency fund – our everyday lives are full of teachable moments we can and should share with our children.

We wanted to share some money tips and topics to discuss with the children in your life, plus online materials (they will consider videos and games) that will hold kids’ attention while teaching them money management. Keep reading to get to the head of the class.

Being in Charge of the Budget

Are your children constantly asking you for money? I heard about a father who found a way to nip that in the bud. He had his teen and preteen sign a contract stating what expenses he would pay for, then gave them a set amount of money to spend each month for clothing, cellphone bill and extras. His son’s hard lesson came when his friend pushed him into a pool – along with his cellphone. He learned why it’s important to build a reserve for unexpected expenses. Giving your kids a paycheck allows them the chance to make financial decisions – and experience the consequences firsthand.

The Economics of Higher Education

We’ve all asked a kid, “What do you want to be when you grow up?” Instead, ask what their interests are, and help them explore how they might be applied in a future career. This teaches them adaptability, something of value in a changing economic landscape.

As they get closer to making a decision about whether to attend college or trade school, help them think through the costs and benefits. Junior Achievement’s Access Your Future app can help them crunch the numbers.

The Roots of Retirement

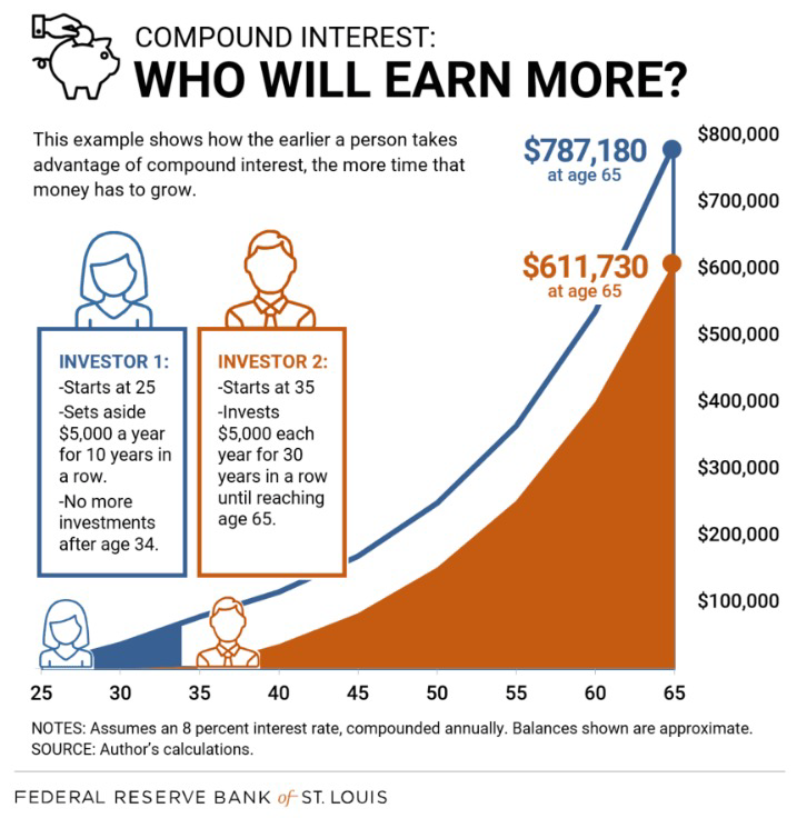

Raise your hand if you want to raise a child who will hit the ground running when it comes to saving for retirement. Teaching kids the discipline of saving and the impact of saving early is one of the most valuable lessons they can learn. To help them understand the value of compounding, help them open a savings account (or guardian-type brokerage account) where they can experience the power of this phenomenon for themselves.

I’ve always loved this illustration:

Learn the Extra about Credit

When you’re young and don’t have much money, it’s easy to rely too much on credit and jeopardize your financial future. Share stories about how you paid for your first car or house, and explain in concrete terms how the interest rate affected the overall purchase price. Consider adding your teen or college student as an authorized user on your credit card and teaching them how to read a statement and pay the balance in full each month.

Resources

Search ngpf.org/arcade for web-based games like “Money Magic,” “Payback,” “Stax” and “Credit Clash”

Other Ideas

In giving your child the gift of financial literacy, you’re helping set them up for a brighter future. Through a purposeful approach, we can all do our part to raise the next generation of resourceful citizens.

This material is not financial advice or an offer to sell any product and is not a recommendation to buy or sell any particular security. The opinions expressed are those of the Saling Wealth Advisors’ Management Investment Team and are subject to change without notice.

Saling Wealth Advisors (“SWA”) is an independent SEC registered investment advisor. Registration does not imply a certain level of skill or training. This material is provided for informational and educational purposes only. More information about SWA including our advisory services, fees, and objectives can be found in our Form ADV Part 2A, which is available upon request.